- In control terms and conditions: Are definitely the conditions predatory so you can customers?

Whenever looking to a reputable pay-day lender, it is important to determine the protection and you can safety of one’s lender, particularly if it is an on-line application. The simplest way to ensure the web site is secure is through checking to see if discover an enthusiastic HTTPS through to the web address. This new S suggests that the machine one servers this site is safe, plus personal information is actually less likely to end up being acquired by the scammers.

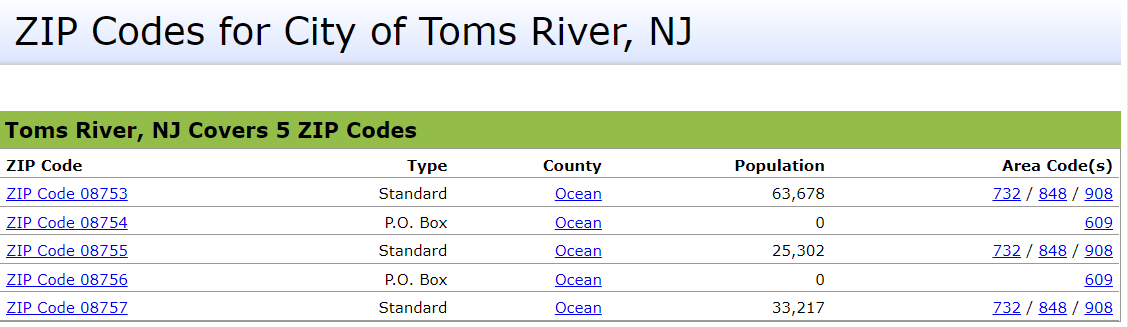

Regrettably, not every online lending system does organization in almost any state, thus lookup the website getting confirmation that they’ll provide within the your state.

While you’re lookin from the conditions and terms, review their typical conditions getting borrowing and you will repayment. If the their attention prices come into multiple digits, it should be perhaps not a good solution.

Storefront Payday Loan providers

There is certainly more than likely a pay-day lender closer to your work otherwise family than just you know. In fact, by 2017, there had been 14,348 pay day loan storefronts in america. That is so much more payday lenders than you can find McDonald’s!

The fantastic thing about using a storefront pay day financial would be the fact you can be certain he is signed up to operate in your condition and can stay glued to their laws.

The item regarding getting a payday loan off a storefront lender would be the fact you are going to need to go back to the store if it is time and energy to pay-off. This isn’t always by far the most much easier circumstance for busy specialists. If you can’t pay back the loan timely, the lender usually takes this new postdated evaluate you blogged and you will process the fresh check into their part.

Safer Choice in order to Payday loan

Although it seems like by far the most smoother choice during the day, there are numerous other ways locate the means to access dollars rapidly into the a pinch. Although some choices is going to be similarly predatory, there are several that will be more inviting to help you people having subprime borrowing from the bank within the a pinch.

- Regional nonprofit or foundation: Of many neighborhood properties communities promote investment present to assist coverage concepts.

- Borrowing union financing: of many borrowing from the bank unions bring a pay check alternative financing with a notably lower interest rate and you will expanded installment schedule.

- Household members mortgage: Use out of a relative otherwise pal in place of interest.

- Pay day loan software: These programs costs reasonable or no charges otherwise attention.

Talk about all options to see if one of those loans will get be more effective for the budget. If you have the go out, you can strive to alter your credit score, get a hold of a cosigner, otherwise check out a protected mortgage.

Compassionate Capital

Although it may seem like there clearly was no one you can trust to help you get an instant payday loan quickly, you will find lenders who place the economic fitness out of borrowers firstpassionate financing appears past an individual’s credit score to grow all the way down-pricing capital access. This is one of the pillars out-of BrightUp’s economic wellness masters.

Unveiling the BrightUp Disaster Financing

BrightUp offers an urgent situation Financing installment loans no credit check Denver CO giving a similar convenience while the an instant payday loan, without the unreasonable words. Having staff that have entry to our economic fitness professionals, there’s no lowest credit history needed to access doing two weeks out-of shell out beforehand.

If you are other pay check loan providers do couples the advance with a high attention rates and you will a 2-week cost several months, we offer one-hand Annual percentage rate and a 2-12 months installment several months. The only real requirement is that you are located in a updates with your workplace for at least 1 year.

End Monetary Issues afterwards

Along with linking workers in addition to their household that have accessible investment getting issues, you want to empower readers to your think tools and you will recommendations they want to learn how to cut for issues on the upcoming.