If you utilize an enthusiastic FHA mortgage purchasing a property, it is possible to accumulate certain charge and you will costs in the act. With each other, talking about labeled as their FHA closing costs. A number of the costs come from the borrowed funds lenders. Someone else come from businesses instance domestic appraisers, label companies, and you can borrowing-revealing companies.

FHA closing costs average to 3% of home’s price. They will vary of the state, that have financing will cost you becoming large inside the claims that have highest income tax costs. There are more parameters that affect the total matter you shell out at closure, eg prepaid service focus affairs.

Likewise, HUD lets the seller to pay a number of the customer’s will cost you, as much as 6% of the purchases price quite often. Regardless of if you should ask for a provider concession have a tendency to confidence local field standards.

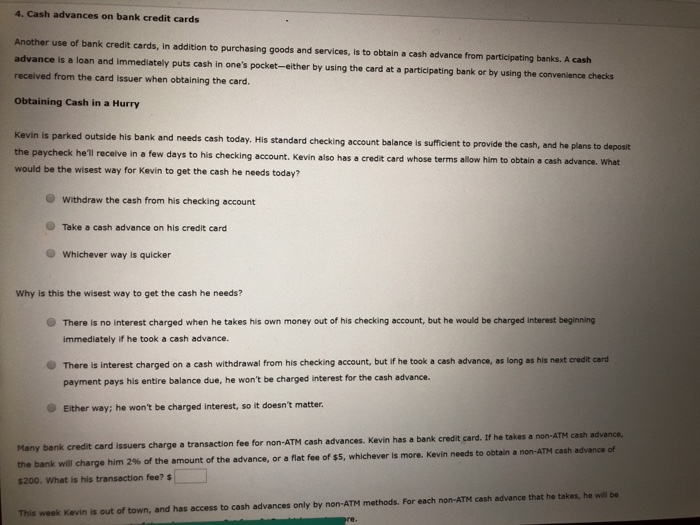

Average FHA Settlement costs for People, 2017

With regards http://www.availableloan.net/installment-loans-ms/blue-springs to the Government Put aside, closing costs to have FHA and you can traditional money average up to step three% of your own residence’s cost. But in some areas which have higher taxation costs, they may be all the way to 5% otherwise 6%. These averages has one another bank and you can 3rd-cluster costs.

* These are just average FHA closing costs. The actual count you have to pay vary depending on numerous issues. Your mortgage lender would be to make you financing imagine once you get a home loan, and that document will teach your projected settlement costs.

As previously mentioned prior to, geography takes on a job here. Specific states have average FHA closing costs that will be doubly highest just like the almost every other states. So that the number you have to pay to close off your loan could be high otherwise less than the fresh new quotes found a lot more than, partly according to your geographical area. According to Bankrate, the newest claims for the high closure rates averages were The state, Nj-new jersey, Connecticut, Western Virginia and you can Arizona.

Write off Activities Enhance your Upfront Can cost you

As well as venue and you may financing proportions, there are more variables that can change the count you have to pay within closing. For-instance, if you decide to shell out disregard points to safe a reduced mortgage speed, it will boost your full closing costs. Nevertheless also slow down the number of focus you have to pay across the long haul, and therefore can perhaps work out over your own advantage.

This is certainly a primary reason it’s hard to offer a particular amount to possess mediocre FHA settlement costs. Specific borrowers spend points in advance, in return for less mortgage rate. Other borrower prefer to skip the situations and take the greater price, so you can remove the upfront will cost you.

You to dismiss section means one percent of your amount borrowed. Such, a house customer who is borrowing from the bank $two hundred,one hundred thousand do pay $dos,000 getting just one discount section (so you can safe less financial rates). This additional expense often is rolled inside toward other closing costs, it escalates the amount owed towards closure date.

Loan Estimates and you will Closure Disclosures

Average FHA closing costs aren’t very useful, of a monetary considered position. To have believe intentions, you should have some idea exacltly what the will cost you is. Luckily, you will find some authorities-required mortgage documents built to assistance with which. These represent the loan estimate together with closing disclosure.

The Discover Before you Are obligated to pay home loan revelation rule, observed because of the Individual Monetary Safety Bureau (CFPB), demands lenders to give a price of FHA settlement costs after your make an application for financing. So it document is known as the brand new financing imagine. It highlights the very first components of your order, letting you effortlessly evaluate will cost you among contending lenders. It document are offered contained in this three business days of application.

Lenders must leave you several other file, known as the closure revelation a few days before you could romantic. This will be a current file that shows exacltly what the actual (maybe not estimated) costs would-be.

Summation: The average FHA closing costs found over make you good ballpark notion of what homebuyers have to pay. you ought not to explore those individuals wide variety to have believed otherwise decision-making. Alternatively, make use of the Financing Estimate form provided with the financial to track down a far more exact picture of your closing costs.