You usually won’t need to assess your property collateral loan commission oneself. For the loan application processes, you’ll get financing estimate towards the payment per month count that remains repaired regarding the title. You will also discover your own fee amount on your monthly report and you can financial portal.

Although not, you need a finance calculator to guess your percentage and you will only plug regarding number. You will have to know the loan amount, rate of interest, and title. you will perform new computation yourself making use of the pursuing the algorithm for simple desire amortized loans:

/ <(1>, where P stands for your original home equity loan principal, r stands for the annual interest rate, n stands for the annual number of payments, and t stands for the term in years.

Determining How much cash To blow

To get rid of default, create americash loans Dunnavant at the very least the minimal household guarantee financing commission punctually. If you’re unable to build your commission, get hold of your bank from the payment arrangements. Prevent skipping a payment or and work out a lower percentage versus bringing see.

Paying additional towards the primary might help eliminate overall interest, help make your residence’s security, and pay the loan quicker. But before you only pay away from the loan early, check with your bank to see if the loan has actually good prepayment punishment.

Solutions to help you House Equity Financing Payment

If you would like a reduced payment, other label, otherwise all the way down interest rate, believe particular choices in order to paying back your residence collateral financing.

New house Collateral Mortgage

Refinancing comes to taking yet another family collateral loan to pay off your current you to definitely. This may offer an opportunity to get a much bigger amount borrowed if you have enough guarantee so you can meet the requirements, or even protect a better rate of interest than simply your already get.

Refinancing constantly includes settlement costs and requirements your combined loan-to-well worth ratio (like the present house guarantee loan) actually too much to help you be considered.

Family Security Credit line (HELOC)

An excellent HELOC also allows you to tap your property guarantee, it provides you with an effective rotating line of credit which have loans you need to use for your goal, as well as settling your property security loan.

An excellent HELOC will lower your residence security loan if you have enough remaining collateral to help you qualify. It offers the flexibleness regarding an open line of credit getting good specific draw period. Good HELOC usually has an adjustable interest, so your payment matter can change. In addition sells the possibility that you’ll face a beneficial balloon fee, or large fee, at the end of the loan.

Cash-Away Refinance

For people who be eligible for refinancing their unique financial, you can aquire a money-aside home mortgage refinance loan enabling one take out a larger home loan to gain access to the equity. You should use that cash to repay your house security loan and you may move extent into your mortgage.

Which have a funds-away re-finance, you might need to go through a long software procedure that have closing will set you back. Of course, if your house manages to lose value, you have an elevated likelihood of are underwater on the mortgage.

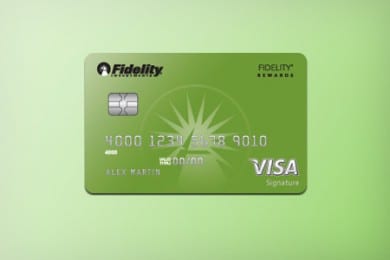

0% Balance Transfer Provide

Whether your charge card issuer lets it, make use of a beneficial 0% equilibrium import render to go over-all otherwise a fraction of your home guarantee loan equilibrium and you may save on notice. So it is most effective when you yourself have a lowered harmony you can completely pay off before promotion period closes.

It is important that you have an agenda to possess repaying this new bank card through to the introductory title concludes. If not, you might likely end paying a considerably higher rate for your mastercard than your residence collateral mortgage, and you also might go greater on the financial obligation. Your will often have to expend a balance import percentage for using transfers of balance.