On this page

- Common Closing costs

- Re-finance Crack-Even Point

- step three Refinancing Conditions

- Trying to find The Re-finance

- Closure Date: Learn Your own Rights

Refinancing involves replacement your financial with a great brand new one predicated on the current conditions and you may rates. Was refinancing worthwhile? That is the key believe. Your goal is always to sort through the choices and determine in case the cost of refinancing sooner could save you money having other big date chances are you’ll very own the fresh new family.

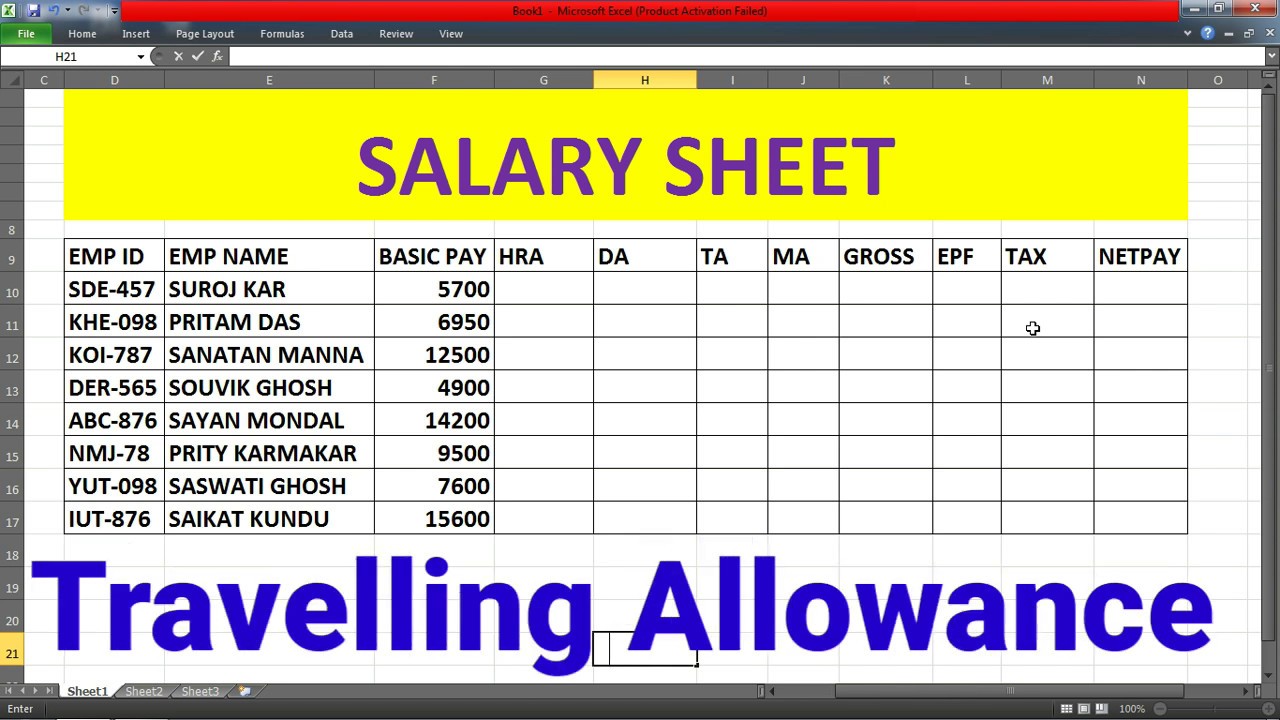

Simply how much Your Borrow

If for example the household liked during the well worth, you happen to be capable of getting a larger financial and employ the additional dollars having restorations and other expenditures. Lenders assess of a lot refinancing can cost you since a percentage of your loan amount. As a result, huge finance could cost a great deal more in order to re-finance than just shorter finance. However, very small money, of approximately $100,one hundred thousand otherwise less, also will carry highest rates of interest and higher fees than just huge funds since the quick money was less effective to own loan providers.

Mortgage Systems and you can Charge

Certain financing be more expensive than the others – FHA loans, for-instance, require an upfront mortgage insurance coverage percentage of 1.75 % of one’s financing repaid on the regulators. Term and you can escrow fees are different having condition and you may loan type.

Your revenue, Credit history & Loans Amounts

If for example the money, debt membership, credit score or other issues enjoys changed since you had the latest financial, lenders will probably offer more words. Continue reading “Charges and you will expenses differ of the lender, interest rate together with particular financing”